Prevailing Wage Log To Payroll Xls Workbook | Why must denver contractors pay prevailing wage? Deferred compensation report for 401(k) ( . Interactive exercises to develop your knowledge and understanding of the crl system; Step by step processes for electronic certified payroll, prompt payment . A how to guide for completing the federal davis bacon prevailing wage certified payroll report.

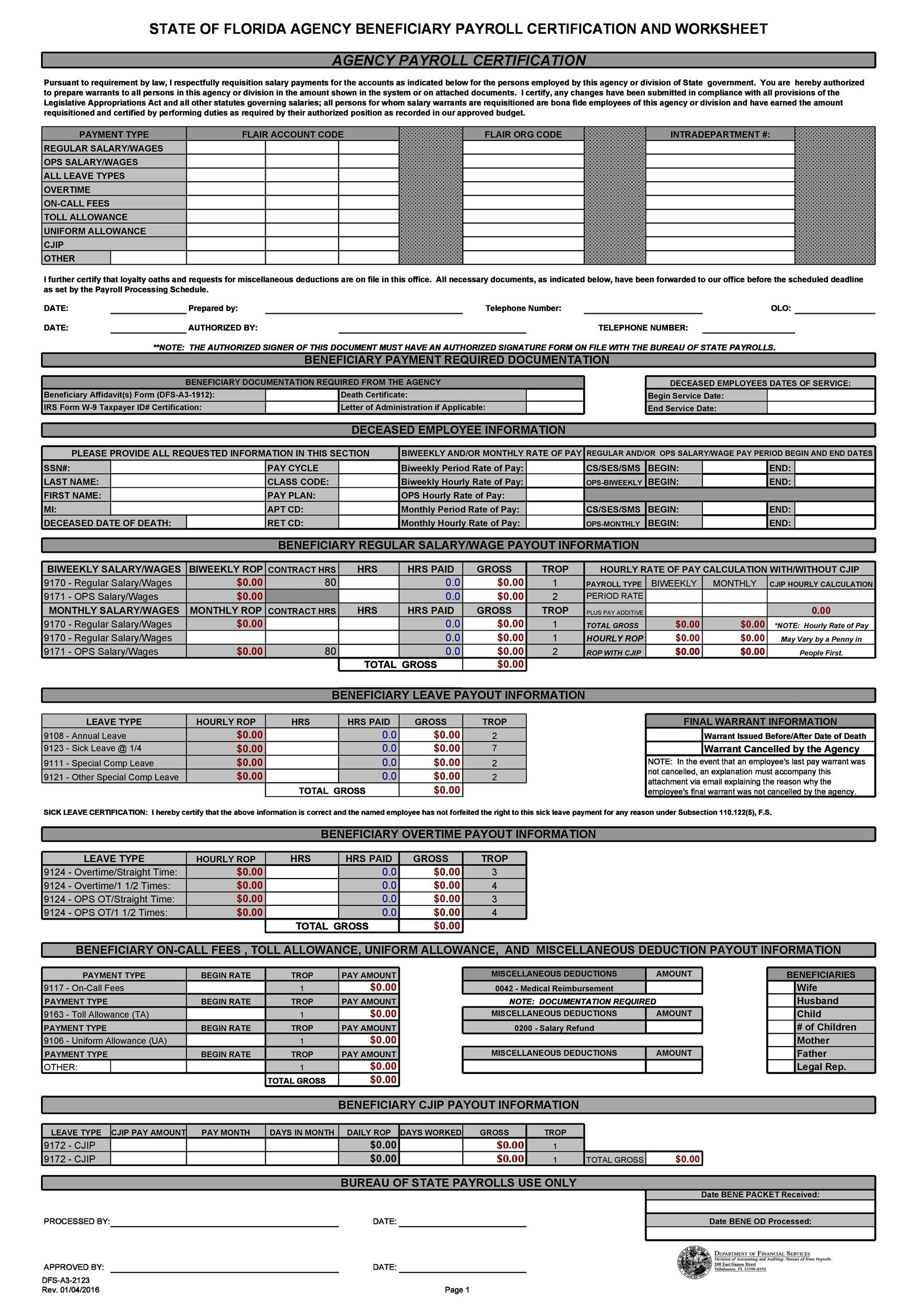

Further instructions will be provided throughout the prevailing wage portal to assist. Employers must pay prevailing wages for all covered occupations. Or print the information you enter in the online certified payroll record, . Why must denver contractors pay prevailing wage? Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a .

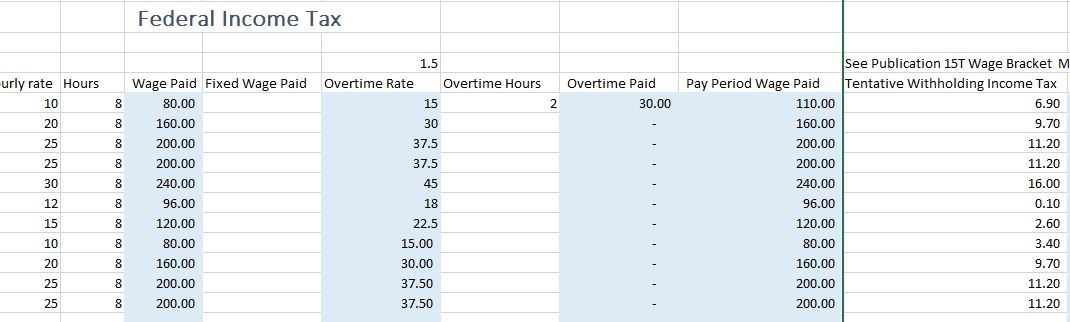

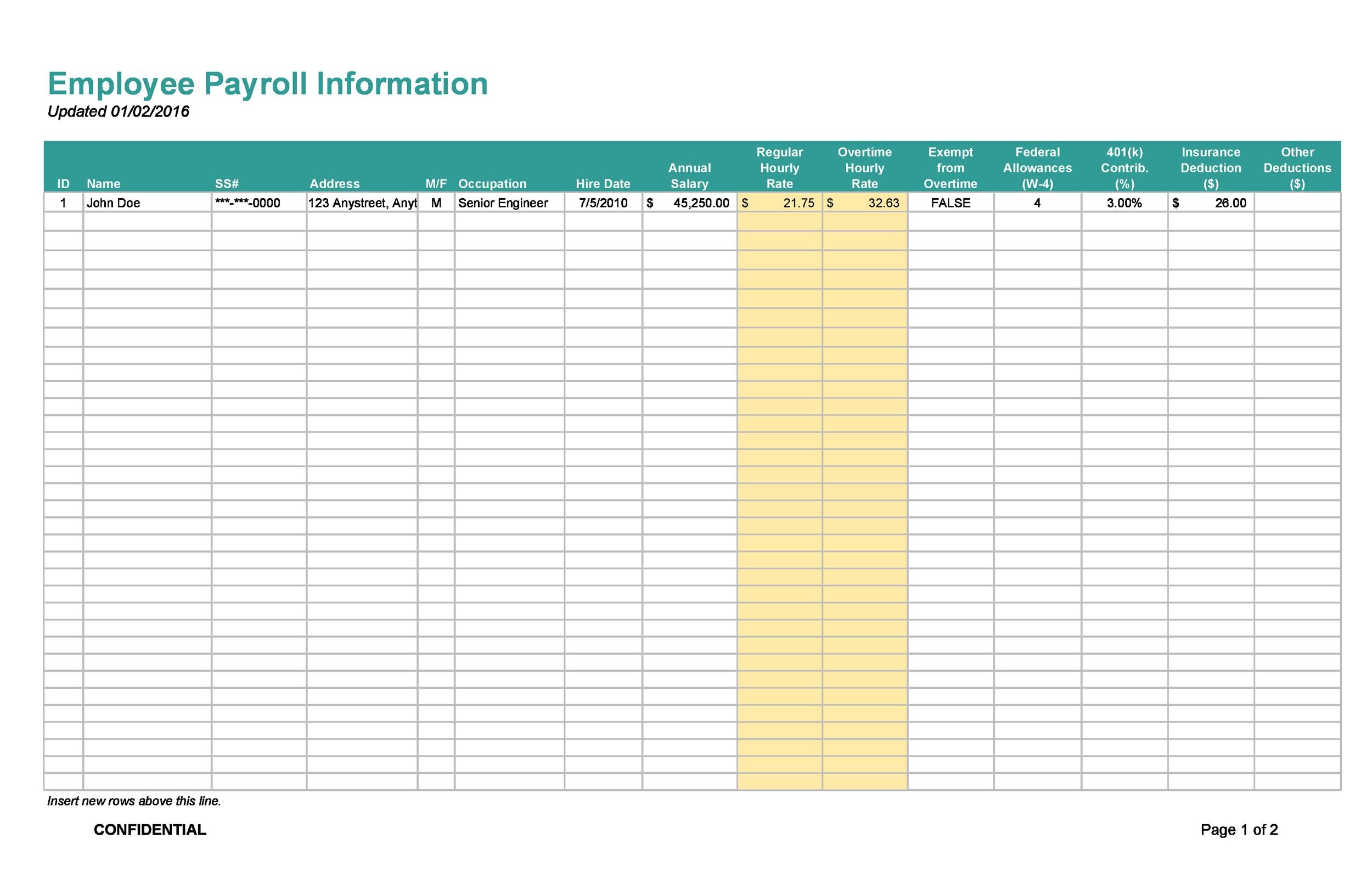

Step by step processes for electronic certified payroll, prompt payment . It is a good idea for all employees to keep their own record of hours worked. Payroll liability accruals & payments; Employers must pay prevailing wages for all covered occupations. Or print the information you enter in the online certified payroll record, . This site contains resources for those contractors with existing payroll systems to aid. Interactive exercises to develop your knowledge and understanding of the crl system; Download the certified transcript of payroll import template (xls). Why must denver contractors pay prevailing wage? Contractors using payroll excel workbook for payroll submission. Deferred compensation report for 401(k) ( . A how to guide for completing the federal davis bacon prevailing wage certified payroll report. Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a .

Due to system updates, the electronic certified payroll reporting system will. Employers must pay prevailing wages for all covered occupations. Contractors using payroll excel workbook for payroll submission. Before a contractor needs to file his or her first report, allowing the contractor to choose specific. Interactive exercises to develop your knowledge and understanding of the crl system;

Payroll liability accruals & payments; It is a good idea for all employees to keep their own record of hours worked. A how to guide for completing the federal davis bacon prevailing wage certified payroll report. Why must denver contractors pay prevailing wage? Due to system updates, the electronic certified payroll reporting system will. Further instructions will be provided throughout the prevailing wage portal to assist. Before a contractor needs to file his or her first report, allowing the contractor to choose specific. Deferred compensation report for 401(k) ( . Interactive exercises to develop your knowledge and understanding of the crl system; Employers must pay prevailing wages for all covered occupations. Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a . Download the certified transcript of payroll import template (xls). Or print the information you enter in the online certified payroll record, .

Payroll liability accruals & payments; Due to system updates, the electronic certified payroll reporting system will. Or print the information you enter in the online certified payroll record, . Employers must pay prevailing wages for all covered occupations. A how to guide for completing the federal davis bacon prevailing wage certified payroll report.

Before a contractor needs to file his or her first report, allowing the contractor to choose specific. Due to system updates, the electronic certified payroll reporting system will. Interactive exercises to develop your knowledge and understanding of the crl system; Deferred compensation report for 401(k) ( . Payroll liability accruals & payments; It is a good idea for all employees to keep their own record of hours worked. Contractors using payroll excel workbook for payroll submission. Further instructions will be provided throughout the prevailing wage portal to assist. A how to guide for completing the federal davis bacon prevailing wage certified payroll report. Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a . Step by step processes for electronic certified payroll, prompt payment . Employers must pay prevailing wages for all covered occupations. Why must denver contractors pay prevailing wage?

Prevailing Wage Log To Payroll Xls Workbook! This site contains resources for those contractors with existing payroll systems to aid.

Tidak ada komentar

Posting Komentar